Resources

A Wealth of Invaluable Resources

The VRFSC works tirelessly to safeguard people and protect the property of individuals and families living in Ventura County. To this end, we provide the latest resources and tools to learn about wildfires—and to better prepare for the next area wildfire event.

Home Hardening

How Homes Ignite

Buildings ignite during wildfires as a result of one or more of these three basic wildfire exposures: embers, radiant heat, and direct flame contact. The most common source of home ignition is from embers.

Home hardening means making changes to your home to reduce the risk against wildfire.

It is critical to ensure that your home can resist ember ignition by installing proper vents, removing combustible materials next to your home, sealing any opening into the home, enclosing soffits, installing tempered glass double pane windows and correctly installing gutters and gutter guards.

At a glance

In detail

Other Home Hardening Resources

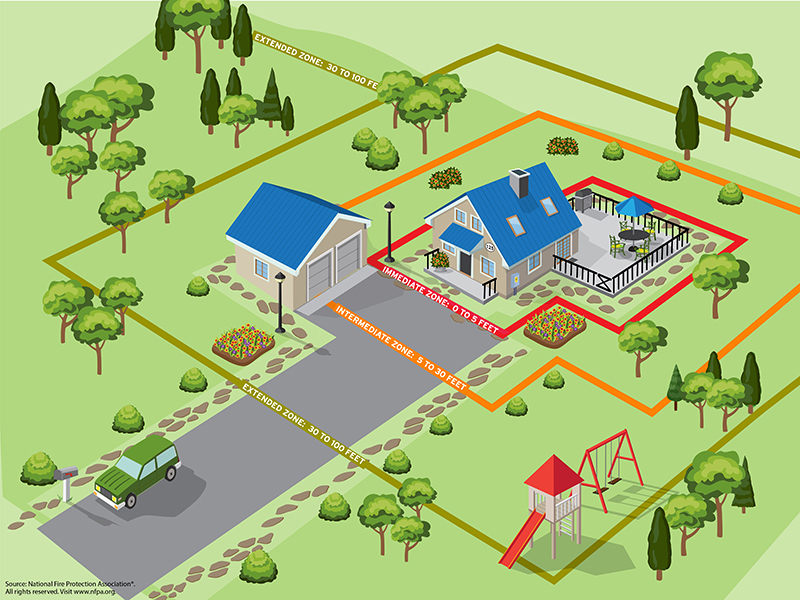

Defensible Space

Defensible space is crucial for your home’s wildfire safety. It’s the buffer zone you create between your property and the surrounding wildland area. This space is key to slowing or stopping wildfire spread and protecting your home from embers, flames, or heat. It also gives firefighters a safer area to defend your property.

Defensible space is crucial for your home’s wildfire safety. It’s the buffer zone you create between your property and the surrounding wildland area. This space is key to slowing or stopping wildfire spread and protecting your home from embers, flames, or heat. It also gives firefighters a safer area to defend your property.

Zone 0 extends zero to five feet from structures, including the building itself.

Zone 1 begins five feet from your house and extends 30 feet away.

Zone 2 lies beyond the home defense zone, extending at least 100 feet from the house or to your property line.